New Delhi:

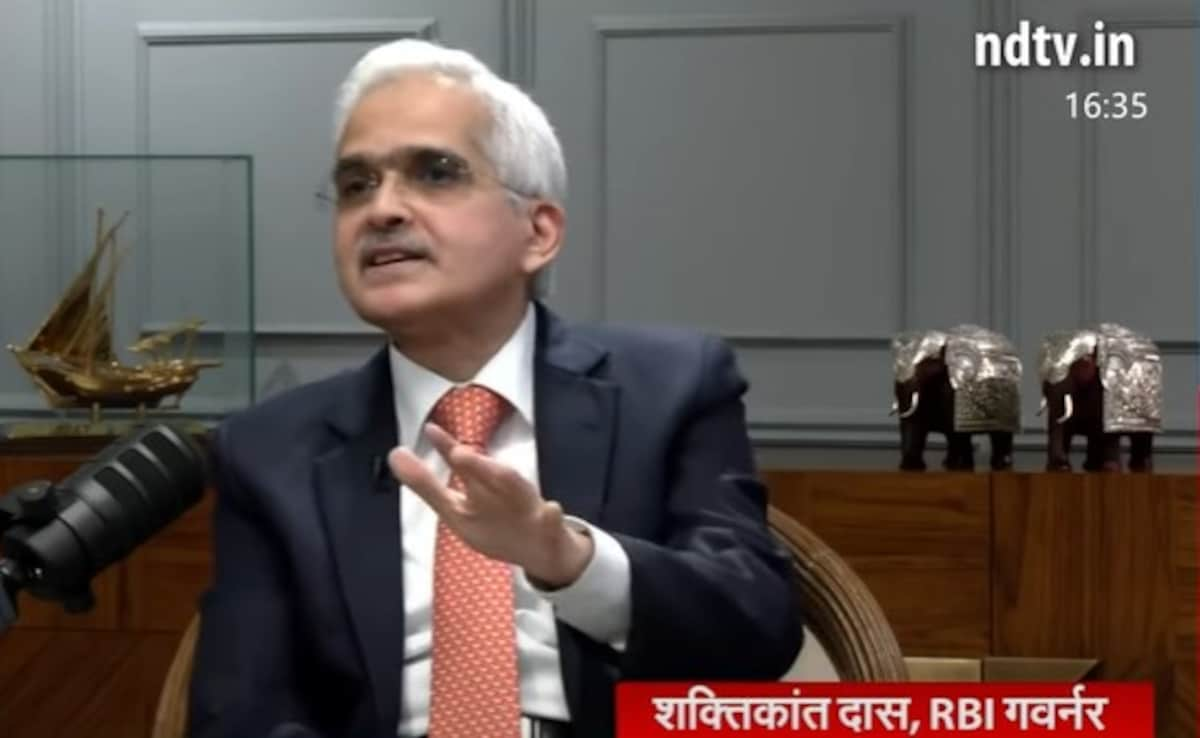

Reserve Bank of India (RBI) Governor Shaktikanta Das on Tuesday said the decision to reduce the key policy repo rate will depend on inflation and the decline in inflation in food items and vegetables in July is not enough to cut rates. The RBI chief said in an exclusive interview with NDTV Editor-in-Chief Sanjay Pugalia, “Any reduction in the policy rate will also depend on future data, with inflation being the biggest influencing factor.”

He said that we want to keep inflation in line with the target. This means that it should be around four percent and we should be confident that it (inflation) will remain around four percent in the future as well. We have to be patient. We have to go further.

We are still the fastest growing country in the world at 7.2%: RBI Governor

The central bank governor (RBI Governor) said that any adverse effect on economic growth due to not reducing the policy rate is “minimal and negligible”. He said, “The compromise with growth is being minimal, almost negligible. We are still growing at 7.2 percent, which is the fastest in the world. Growth is intact, stable, strong, but we need to reduce inflation.”

Will the repo rate be reduced further or not?

He said that if food inflation is very high, then any reduction in rates will not seem credible to the common people.

Denial of expectations of inflation going below 4%

The central bank chief denied that the RBI had ever said that it expected inflation to go below four percent. Shaktikanta Das, referring to the Monetary Policy Committee (MPC) that decides on policy rates, said, “If you look carefully at the details of the MPC meetings, we never said that inflation would go below four percent.”

RBI kept the repo rate at 6.5% for the ninth consecutive time

On August 8, the RBI had kept the key policy repo rate unchanged at 6.5 per cent for the ninth consecutive bi-monthly meeting. The RBI governor said the Monetary Policy Committee (MPC) by a majority of 4:2 decided to keep the repo rate unchanged as inflation has risen above five per cent and is still above the target level of four per cent.

The RBI last changed the rates in February 2023, when the repo rate was raised to 6.5 percent. This increased the rates by a total of 2.5 percent between May 2022 and February 2023.

What is repo rate?

The repo rate is the interest rate at which the RBI lends short-term loans to banks to meet their liquidity requirements. This has an impact on the cost of loans that banks lend to corporates and consumers. Cutting interest rates leads to increased investment and consumption expenditure which boosts economic growth. However, increased expenditure also raises the inflation rate as the aggregate demand for goods and services increases.

Thank you for taking the time to read this article! I hope you found the information insightful and helpful. If you enjoyed this type of content, please consider subscribing to our newsletter or joining our community. We’d love to have you! Feel free to share this article with your friends and family, who might also find it interesting.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.