New Delhi:

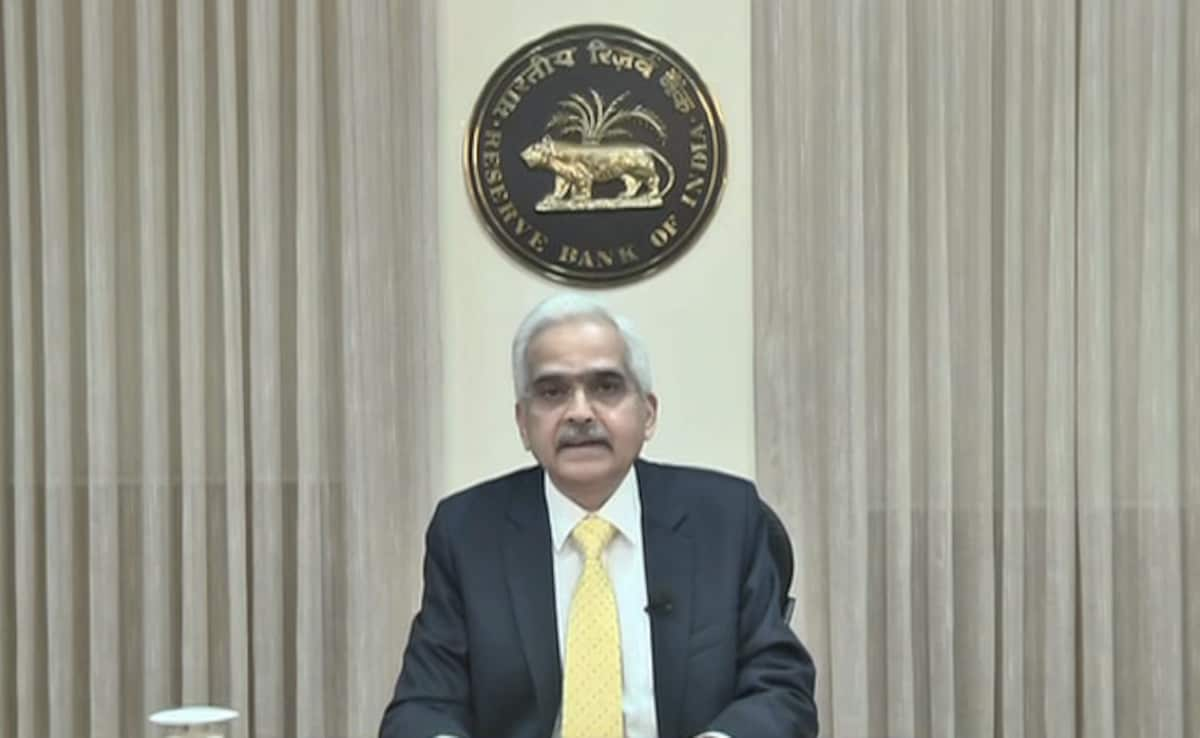

RBI MPC Meet 2024: The assembly of the Financial Coverage Committee of the Reserve Financial institution of India (RBI) is beginning at this time i.e. from seventh October. This three-day assembly is ranging from October 7 and the selections of the committee will probably be introduced on October 9. Modifications in RBI’s coverage charges have a direct affect in your pocket. Will there be a repo fee minimize within the Financial Coverage Committee (MPC) assembly of RBI? Will your house mortgage or automobile mortgage be low cost or costly? Know what impact this resolution can have in your price range.

There isn’t any hope of change within the repo fee within the assembly of RBI Financial Coverage Committee (RBI MPC Assembly) to be held from 7 to 9 October. Trade consultants mentioned this on Sunday.

Ajit Banerjee, Chief Funding Officer and President of Shriram Life Insurance coverage Firm, mentioned, “We really feel that rates of interest will probably be saved unchanged within the MPC assembly. The discount in repo charges will begin when there may be confidence that inflation is below management. ” He mentioned that at current there is no such thing as a risk of decline within the nation’s development fee.

Retail inflation fee in August was 3.65 %

In response to authorities information, the retail inflation fee in August was 3.65 %. The GDP development fee within the first quarter of the present monetary 12 months was 6.7 %. The explanation for that is the discount in authorities expenditure as a result of normal elections. Authorities expenditure has resumed within the second quarter of the monetary 12 months 2024-25. In such a scenario, the expansion fee is predicted to extend.

Mandar Pitale, Treasury Head, SBM Financial institution India, mentioned the RBI MPC will probably be deliberating on world elements similar to inflation graphs in developed economies and the potential for anticipated fee adjustments within the close to future amid uncertainty over current choices on rates of interest and Anticipated to do.

No change in repo fee after February 2023

Earlier, within the final assembly held in August, the committee had maintained the repo fee at 6.5 %. RBI has not modified the repo fee since February 2023.

Thanks for taking the time to learn this text! I hope you discovered the data insightful and useful. Should you loved such a content material, please contemplate subscribing to our e-newsletter or becoming a member of our neighborhood. We’d like to have you ever! Be happy to share this text along with your family and friends, who may also discover it fascinating.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.