New Delhi:

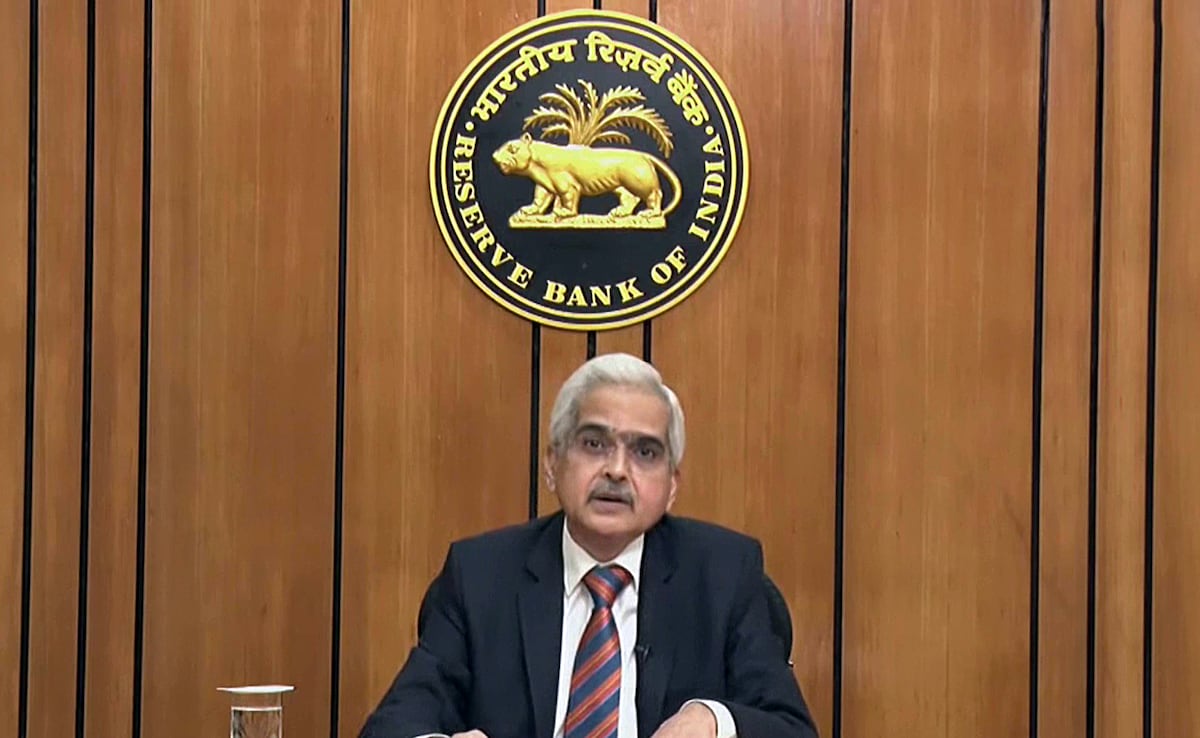

RBI Financial Coverage Assembly: The outcomes of the Financial Coverage Committee (MPC) assembly of the Reserve Financial institution of India (RBI) had been introduced. Reserve Financial institution of India Governor Shaktikanta Das has introduced the choices of the MPC assembly. RBI has not made any change within the repo charge for the eleventh consecutive time.

Which means the EMI of your mortgage is just not going to extend. Nevertheless, in such a scenario, these taking house mortgage and automobile mortgage is not going to get aid in EMI. At present the repo charge is 6.50%, which is steady from February 2023. Market consultants had been already anticipating that there could be no change within the repo charge this time too.

What’s repo charge?

Allow us to inform you that repo charge is the speed at which industrial banks borrow cash from RBI. RBI makes use of repo charge to regulate inflation. If inflation is growing then RBI can enhance the repo charge, because of which banks can even give loans to their prospects at larger rates of interest. With this, individuals will spend much less and inflation will scale back. Quite the opposite, if the economic system is sluggish then RBI can scale back the repo charge. With this, banks will get cheaper cash and they’re going to additionally give loans to prospects at decrease rates of interest. This may make individuals spend extra and the economic system will get a lift.

CRR diminished from 4.5% to 4%

As a way to enhance liquidity within the economic system, the central financial institution diminished the CRR (Money Reserve Ratio) from 4.5 p.c to 4 p.c. In accordance with the RBI Governor, a choice has been taken to scale back CRR by 50 foundation factors, after which the money reserve ratio has been diminished to 4 p.c. With this step, more money of Rs 1.16 lakh crore will likely be out there in banks.

CRR implies that banks need to deposit a sure portion of their whole deposits with the RBI within the type of money. The remaining cash can be utilized by the financial institution for giving mortgage or for different investments.

RBI Governor stated that our effort is to comply with the versatile focusing on framework of the RBI Act. Worth stability is vital for each sector of our economic system. It impacts the buying energy of individuals, therefore it is necessary for companies additionally.

Standing deposit facility stays at 6.25%

As per the bulletins of the Financial Coverage Committee, the committee has additionally saved the Standing Deposit Facility (SDF) at 6.25 p.c. Financial institution charge and marginal standing facility have been saved fixed at 6.75 p.c. The Committee believes that the muse of excessive progress might be saved robust solely with sustainable worth stability. Standing Deposit Facility (SDF) was launched by the Reserve Financial institution of India (RBI) as a financial coverage instrument on April 8, 2022. Had gone.

The RBI Governor stated that financial coverage has a wide-ranging affect, worth stability is vital for each sector of the society and we’re working retaining in thoughts the financial progress. He stated that vital information signifies that the second half of the present monetary 12 months Financial progress will speed up.

RBI diminished the expansion charge estimate for the present monetary 12 months from 7.2% to six.6%.

GDP progress charge within the July-September quarter was decrease than anticipated at 5.4 p.c. In view of the present scenario, RBI diminished the financial progress charge estimate for the present monetary 12 months from 7.2 p.c to six.6 p.c. Together with this, RBI has elevated the estimate of retail inflation from 4.5 p.c to 4.8 p.c within the present monetary 12 months.

Governor Shaktikanta Das says that the indications indicating slowdown within the economic system within the second quarter are actually in a state of ending. Inflation is prone to stay excessive within the third quarter because of continued strain on meals costs.

Thanks for taking the time to learn this text! I hope you discovered the knowledge insightful and useful. If you happen to loved any such content material, please take into account subscribing to our e-newsletter or becoming a member of our group. We’d like to have you ever! Be happy to share this text along with your family and friends, who may additionally discover it attention-grabbing.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.