The Finance Ministry has launched a be aware within the type of steadily requested questions (FAQ) concerning the Direct Tax Vivad Se Vishwas Scheme, 2024.

Click on right here to attach with us on WhatsApp

“With a view to facilitate the assorted queries raised by the stakeholders following the enactment of the Direct Tax Vivad Se Vishwas (DTVSV) Scheme, 2024, the Central Board of Direct Taxes (CBDT) has at the moment issued a Steering Observe within the type of Incessantly Requested.” Questions (FAQs). This be aware is designed to supply readability and help taxpayers in higher understanding the provisions of the Scheme,” mentioned the ministry in a press assertion.

What’s Direct Tax Vivad Se Vishwas

The Direct Tax Vivad Se Vishwas (DTVSV) Scheme, 2024, was introduced within the Union Finances 2024-25 to resolve pending earnings tax disputes. The scheme was enacted by way of the Finance (No. 2) Act, 2024. Moreover, the corresponding Guidelines and Types for implementing the Scheme had been notified on September 20, 2024.

Which kind of tax appeals are lined below DTVSV

An individual who has an enchantment, writ petition (WP), or particular go away petition (SLP) filed by both themselves, the Earnings Tax authority, or each, earlier than an appellate discussion board, with the matter nonetheless pending as of the required date, i.e. , July 22, 2024; or

An individual who has submitted objections earlier than the Dispute Decision Panel (DRP) below Part 144C, and the DRP has not issued any instructions by July 22, 2024; or

An individual whose case has acquired instructions from the DRP below Part 144C (5) however the assessing officer (AO) has not accomplished the evaluation below Part 144C (13) by July 22, 2024; or

An individual who has filed an software for revision below part 264 of the Act, and the applying stays pending as of July 22, 2024.

Which circumstances are usually not lined below the scheme

Instances pertaining to an evaluation 12 months the place the evaluation was accomplished below Sections 143(3), 144, 147, 153A, or 153C, based mostly on a search carried out below sections 132 or 132A.

Instances associated to an evaluation 12 months the place prosecution was initiated earlier than the declaration was filed.

Instances involving undisclosed earnings from international sources or undisclosed property positioned outdoors India.

Instances the place the evaluation or reassessment was based mostly on data acquired by way of an settlement below sections 90 or 90A, if it pertains to any tax arrears.

Forms of kinds specified within the scheme

Kind-1: Kind for submitting declaration and endeavor by the declarant.

Kind-2: Kind for certificates to be issued by designated authority.

Kind-3: Kind for intimation of cost by the declarant.

Kind-4: Order for full and last settlement of tax arrears by designated authority.

What are varied timelines specified within the scheme

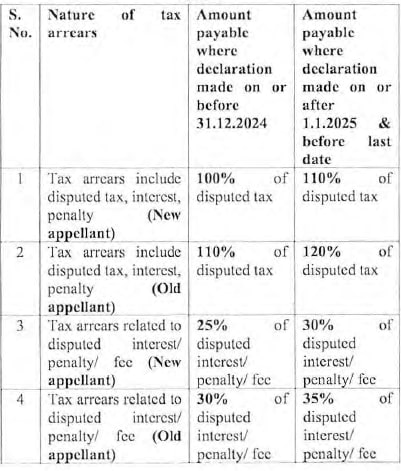

Declaration and Endeavor shall be filed by tax payer in Kind-1 on or earlier than 31.12.2024 to maintain the quantity payable on the decrease threshold. In case of submitting the declaration and endeavor past 31.12.2024, quantity payable will improve as laid out in, charges Desk-1 above.

The Designated Authority shall challenge Kind-2 inside a interval of fifteen days from the date of receipt of the declaration to find out the quantity payable by the taxpayer.

The tax-payer shall pay the quantity as decided in Kind-2 inside a interval of fifteen days from the date of receipt of the certificates, and shall intimate the main points of such cost in Kind-3.

Upon receipt of Kind-3, Designated Authority shall move an order in Kind-4 stating that the tax-payer has paid the total and last quantity.

Are disputes associated to different taxes lined?

Solely Earnings Tax disputes are lined.

Primarily based on the round issued by the tax division, here’s a desk outlining the proportion of the disputed quantity that must be deposited when making use of for the Direct Tax Vivad Se Vishwas 2024 Scheme.

First Printed: Oct 16 2024 | 11:28 AM ist

Thanks for taking the time to learn this text! I hope you discovered the knowledge insightful and useful. When you loved such a content material, please take into account subscribing to our e-newsletter or becoming a member of our neighborhood. We’d like to have you ever! Be at liberty to share this text together with your family and friends, who may additionally discover it attention-grabbing.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.