New Delhi:

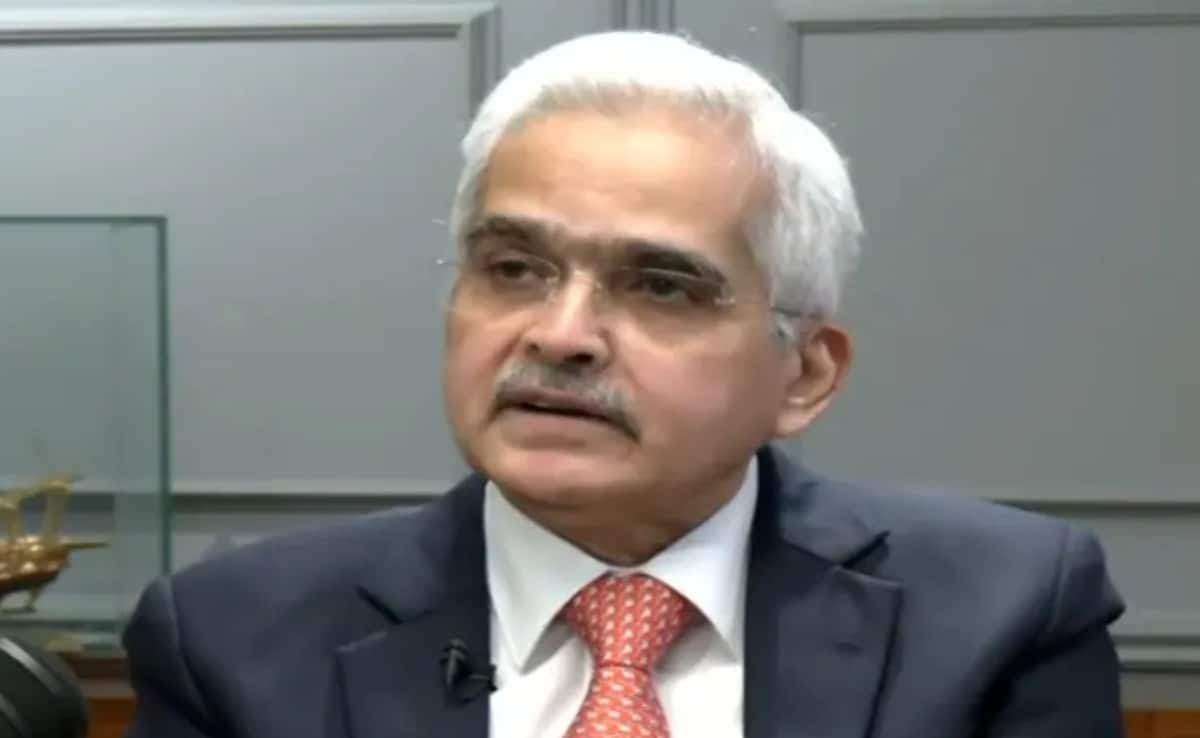

RBI, i.e. Reserve Bank of India Governor Shaktikanta Das says that young Indians are ambitious, and instead of depositing money in banks, they are investing money in volatile markets like stock market and mutual funds. This is not going to cause any immediate problem, but if this trend continues, then there may be a liquidity problem in the future, so banks should keep an eye on this and think of solutions, and launch such schemes or products that will attract deposits to them.

“It is good for Indians to invest in shares…”

During an exclusive interview with NDTV Editor-in-Chief Sanjay Pugalia, the RBI chief said, “Indian youth are very ambitious in the internet age, and this happens all over the world… Everything comes out through the internet, and the youth invest money in different places… This is a good trend, and it shows that the youth have faith in the country’s economy… We are just advising banks to be proactive on this… This trend is not going to cause any immediate harm, but in the future it can create structural liquidity problems…”

“Long term deposit, credit growth imbalance is not good…”

Shaktikanta Das said, “If the difference between deposit and credit growth continues, it will create liquidity problems… If credit is increasing but deposits are not increasing, there will be no problem for a year or six months… This trend has also started from last year… But if it continues, it can cause problems, so banks will have to work very carefully on liquidity management in a proactive manner and maintain a balance between deposit and credit growth…”

Along with this, the RBI governor also said that banks are also understanding this future problem. He said, “The positive thing is that banks are also understanding this, and many banks have started raising money through infrastructure bonds… The specialty of infrastructure bonds is that they are available at attractive prices, and from the point of view of banks, infrastructure bonds are not deposits, so banks do not have any reserve requirement, that is, there will be no restriction on banks to keep so much amount in CRR…”

Further, speaking on the related issue of stability of banking, Shaktikanta Das said, “Attention has been paid to the level of governance of banks and NBFCs, and it has also seen improvement in the last few years…”

Thank you for taking the time to read this article! I hope you found the information insightful and helpful. If you enjoyed this type of content, please consider subscribing to our newsletter or joining our community. We’d love to have you! Feel free to share this article with your friends and family, who might also find it interesting.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.