)

Mark Mobius Photograph: Bloomberg

By Selcuk Gokoluk and Joumanna Bercetche

Rising-market equities will likely be boosted by stimulus measures in China because of the nation’s giant weightings in indices and shut financial ties with different growing international locations, in response to veteran investor Mark Mobius and Goldman Sachs strategists.

Click on right here to attach with us on WhatsApp

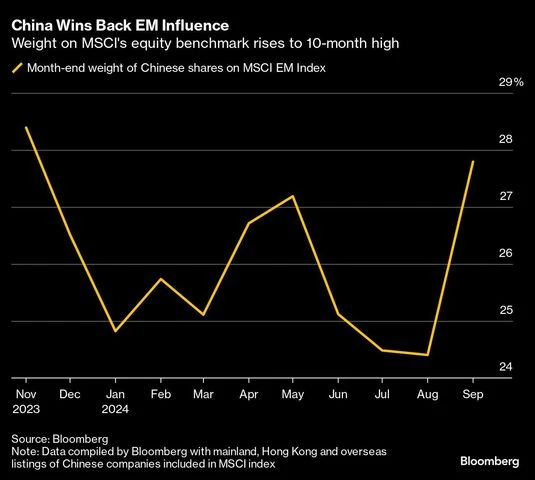

China accounts for one quarter of the benchmark MSCI EM fairness index and it means when China markets rally, the index additionally strikes up. Stimulus measures, coupled with a Federal Reserve interest-rate minimize, helped emerging-market equities leap 10% from mid-September lows.

China’s easing has broadened the emerging-market fairness rally and it has been powered by outsized beneficial properties in heavy-weight Chinese language equities, Goldman strategists together with Kamakshya Trivedi wrote in an emailed be aware. These have risen practically 40% from their lows, with China’s outperformance in opposition to the remainder of the rising markets up to now three weeks at its widest up to now 25 years.

They mentioned they anticipate additional upside in emerging-market equities, with spillovers from China’s development in a number of international locations corresponding to South Korea, Malaysia and South Africa.

)

Goldman Sachs has raised China to chubby from the market weight in its Asia methods.

Rising-market shares funds had their highest weekly inflows with $41 billion by way of Oct. 9, Financial institution of America mentioned, citing EPFR World information. China equities had file inflows of $39.1 billion within the week.

Mobius, chairman of Mobius Rising Alternatives Fund, mentioned he believes the Chinese language authorities will attempt to stimulate the market extra as a result of they need overseas capital to return. “The Chinese language wish to see the market going a lot better than it has been going even now,” he mentioned in an interview on Bloomberg TV. “In fact there will likely be corrections alongside the best way.”

Fund Allocation

Mobius mentioned round half of emerging-market traders could possibly be monitoring the index, which implies they have to allocate extra funds to China on account of its giant weighting.

“It may be an accelerating growth, with an increasing number of individuals submitting in,” he mentioned. With India, which has the second largest weighting within the EM index, emerging-market equities may have higher prospects of outperformance in opposition to US shares.

Thus far, many traders had been in opposition to China however now that’s altering, Mobius mentioned.

“They didn’t wish to hear something about China as a result of they had been harm so badly” he mentioned. “Now that is altering. As the cash is available in, the overall pool of cash coming into rising markets will develop. You will note this entire market transfer.”

© 2024 Bloomberg LP

First Revealed: Oct 11 2024 | 11:19 PM ist

Thanks for taking the time to learn this text! I hope you discovered the knowledge insightful and useful. If you happen to loved this kind of content material, please think about subscribing to our publication or becoming a member of our group. We’d like to have you ever! Be at liberty to share this text along with your family and friends, who may also discover it attention-grabbing.

Rishabh Singh is the Editor-in-Chief and CEO of Latestnews24.com. He has also completed his graduation in BSC Aviation and has 2+ years of experience in blogging and digital marketing. Have worked with many businesses and blogs, He is also interested in Entertainments/movies/web stories and new foods recipes news, Actually this is his favorite subject. So he is always ready for discussion and written about this topic.