Footfall, enquiries, and bookings at automotive dealerships are rising, pushed by engaging presents and promotions. These particular offers sometimes begin in October and run till the New Yr.

“Many corporations pay Diwali bonuses to staff, boosting buying energy and client sentiment,” says Raoul Kapoor, co-chief government officer (CEO), Andromeda Gross sales and Distribution, a mortgage distribution community.

Click on right here to attach with us on WhatsApp

Apart from negotiating an excellent deal on the automotive, consumers should safe a good mortgage provide.

Festive presents

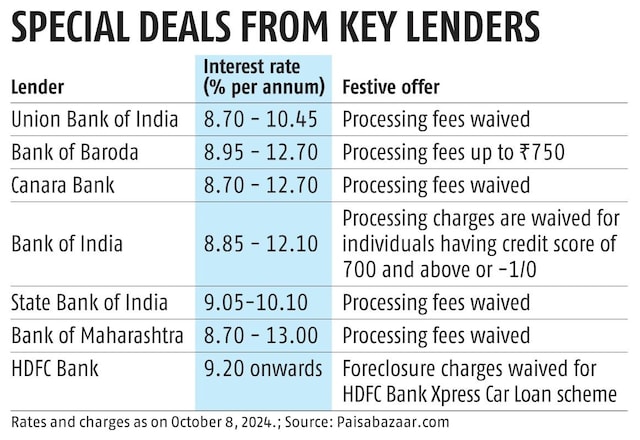

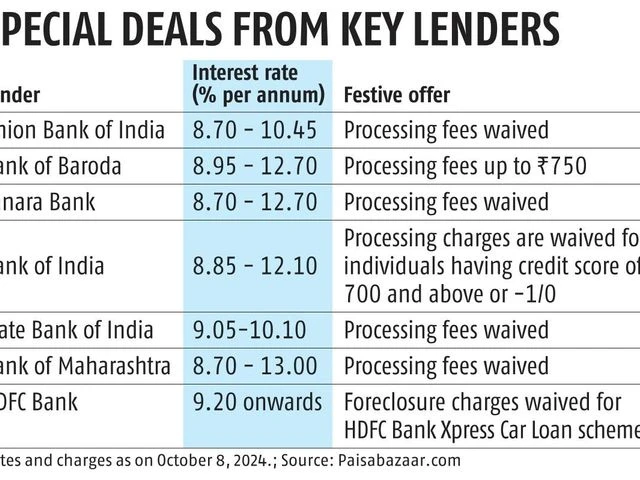

Many banks are providing decrease rates of interest and waiver of processing charges. Some have waived the foreclosures cost (see desk). The important thing query for purchasers is how a lot these presents ought to affect buy choices. Whereas festive presents could sweeten the deal, specialists advise evaluating the general mortgage phrases. “Past the perks, evaluate the rate of interest and mortgage tenure, and test for hidden charges,” says Kapoor.

rate of interest

Evaluate rates of interest supplied by numerous lenders. “Tailored schemes could provide important compensation flexibility, with snug equated month-to-month installments (EMIs). Nevertheless, they won’t compensate for the next charge of curiosity. Even when the mortgage tenure is 2 to 3 years, the next rate of interest can negate the advantages,” says Adhil Shetty, chief government officer (CEO), BankBazaar.com.

Take into account whether or not to go for a hard and fast or floating-rate mortgage. Lenders could provide fixed-rate loans at decrease rates of interest with no prepayment costs. “However the fastened charge will solely be cheaper if rates of interest stay secure or rise throughout the mortgage tenure. If charges fall, a fixed-rate mortgage may very well be dearer,” says Shetty. Charges usually tend to fall within the close to future.

)

Mortgage tenure

Lenders often provide mortgage tenures of as much as seven years. “An extended tenure reduces EMIs however will increase the whole curiosity value, and vice versa,” says Sahil Arora, chief enterprise officer (secured loans), Paisabazaar.

Nevertheless, keep away from EMIs which can be too excessive. “Don’t overstretch your finances,” says Kapoor.

Shetty suggests hanging a steadiness between the mortgage tenure (and therefore the whole curiosity value) and the EMI.

Mortgage-to-value (LTV) ratio

That is the share of the car’s complete value the lender is keen to finance. The steadiness, often called the down cost, have to be paid by the client. Youthful prospects usually desire larger LTVs as a consequence of difficulties in saving for a downpayment.

“Lenders set the LTV ratio based totally on their credit score threat insurance policies and the mortgage applicant’s credit score profile,” says Arora.

Kapoor recommends avoiding 100 per cent financing, as making a down cost reduces curiosity value. “A automotive is a depreciating asset, so retaining acquisition prices low is healthier. Solely borrow what’s vital. In case your funds are invested in devices that supply returns a lot larger than the automotive mortgage charge, and you do not need to liquidate them, solely then go for the next mortgage,” says Shetty.

good ideas

Whereas festive presents can scale back prices, debtors must also contemplate the lender’s transparency and repair high quality.

Prospects must be aware of their compensation capability. “Most lenders desire candidates whose complete sum of EMIs stays inside 50-60 per cent of their month-to-month revenue,” says Arora. Kapoor warns in opposition to inflexible mortgage phrases and pointless add-ons that inflate the mortgage quantity. He provides that ignoring prepayment penalties and never studying the mortgage settlement are errors debtors ought to keep away from.

First Revealed: Oct 11 2024 | 10:40 PM ist

Thanks for taking the time to learn this text! I hope you discovered the knowledge insightful and useful. When you loved the sort of content material, please contemplate subscribing to our publication or becoming a member of our group. We’d like to have you ever! Be at liberty to share this text along with your family and friends, who may additionally discover it fascinating.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.