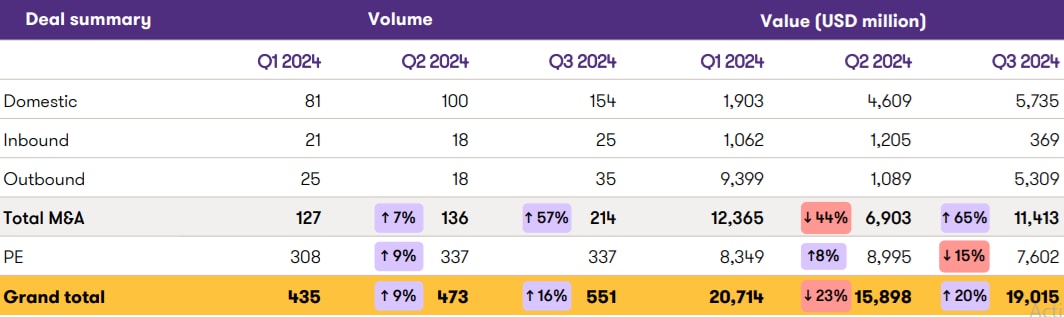

India’s deal-making panorama witnessed a major uptick within the third quarter of 2024, with a complete of 551 offers valued at $19 billion. This marks the very best quarterly deal quantity because the first quarter of 2022, reflecting elevated investor confidence and a sturdy financial setting, in keeping with a report by consulting agency Grant Thornton Bharat.

Key Highlights:

Click on right here to attach with us on WhatsApp

File M&A Exercise: M&A exercise reached an all-time excessive when it comes to deal volumes, recording 214 offers in a single quarter. Three firms have been on an acquisition streak this quarter, i.e., Nazara Applied sciences with 9 acquisitions value $223 million and Aditya Birla Group and Lodha Group with 5 acquisitions every. Cross-border outbound offers marked a ten-year

excessive when it comes to deal volumes, with 35 offers value $5.3 billion.

- Mergers and acquisitions (M&A) contributed considerably to the surge, with a 57% enhance in quantity and 65% in worth in comparison with the earlier quarter.

- Cross-border exercise reached a 10-year excessive, with 35 outbound offers value $5.3 billion, led by Bharti Enterprises’ $4 billion acquisition of a 25% stake in a British telecom group, additionally rising because the deal of the quarter.

- Home exercise additionally noticed a exceptional 54% quantity enhance and 24% worth enhance, reaching an all-time excessive in quarterly volumes.

- Nevertheless, inbound deal values declined sharply by 69%, whereas outbound values surged five-fold.

PE Funding Increase: PE exercise recorded the very best deal volumes since Q3 2022, whereas the bottom quarterly values this 12 months. The retail and shopper sector continued to dominate PE exercise, whereas banking and monetary providers and power and pure assets contributed to the quarter’s values. Moreover, there was a notable enhance in late-stage funding (Collection B to Collection G) when it comes to each volumes and values in comparison with the earlier quarter.

“Excessive-value transactions have been dominated by banking and monetary providers, power and pure assets, and retail and shopper sectors, which captured 56% of the whole PE funding market. Key offers included Brookfield World Transition Fund’s funding in Leap Inexperienced Power, CVC Capital Companions’ funding in Aavas Financiers, and the mixed backing of Zepto by Normal Catalyst, Dragon Fund, Epig Capital, StepStone, Lightspeed, DST and Opposite,” stated Vishal Agarwal, Associate and Non-public Fairness Group & Offers Tax Advisory Chief at Grant Thornton Bharat. .

- The PE panorama noticed 337 offers valued at $7.6 billion, marking the very best deal volumes since Q3 2022. This was largely pushed by rising demand from e-commerce and authorities initiatives.

- Excessive-Worth Offers: Regardless of a 15% decline in deal values in comparison with Q2 2024, the quarter witnessed important exercise in high-value offers, with 23 transactions exceeding $100 million.

- Early-Stage Funding: Seed, pre-seed, and angel levels secured $273 million throughout 80 offers.

- High Deal: Brookfield World Transition Fund I’s $550 million funding in Leap Inexperienced Power Pvt. Ltd. was the most important deal of the quarter.

IPO & QIP Panorama: There was a notable surge in IPO exercise whereas QIP offers noticed an all-time excessive.

The third quarter of 2024 witnessed the very best volumes and the second-highest values in 2024. The highest-performing IPOs span throughout numerous sectors, together with retail and shopper, manufacturing, finance, automotive, and expertise, indicating broad-based market curiosity.

The quarter noticed 25 IPO listings valued at $4.1 billion, marking the very best volumes and second-highest values within the final 12 months, indicating a wholesome funding local weather. High-performing IPOs spanned numerous sectors, together with retail, manufacturing, finance, auto, and expertise, demonstrating broadbased market curiosity and sturdy financial development.

Moreover, QIP exercise reached unprecedented ranges with 42 offers value $6.5 billion, reflecting robust institutional investor confidence.

Sectoral Traits:

1. The telecom sector led in deal values with $4 billion from simply two offers, pushed by Bharti Enterprises’ $4 billion acquisition of a 25% stake in a British telecom group.

2. Retail sector led deal volumes with 112 offers value $1.8 billion, representing a 19% enhance in volumes and a 9% lower in values over Q2 2024.

3. IT & ITes sector witnessed the second-highest quarterly deal volumes with 79 offers valuing $758 million, pushed by tech start-ups.

4. Banking & Monetary Companies sector maintained constant deal volumes with 64 offers and contributed $3.2 billion to deal values pushed by three excessive worth offers (> 300 mn) value almost

$1.5 billion.

5. Power & Pure Sources sector noticed substantial deal exercise with 28 offers totaling $1.4 billion, reflecting a 65% enhance in volumes and a 21-fold enhance in values over Q2 2024.

6. Media & Leisure sector remained sturdy with 37 offers totaling $440 million, representing a 76% enhance in volumes and a 1.6x enhance in values.

7. Notable offers included Bharti Enterprises’ $4 billion acquisition, Mankind Pharma’s $1.6 billion acquisition of Bharat Serums, Leap Inexperienced Power’s USD 550 million fund elevate, Zepto’s

USD340 million fund elevate.

8. Rapido’s $120 million fund elevate, Ather power’s $71 million fund elevate and Moneyview’s $4.6 million funding spherical mark their entry into the unicorn membership.

9. Schooling, Infrastructure, Skilled/Enterprise Companies, Hospitality & Leisure sectors noticed elevated exercise, whereas Manufacturing and Actual Property sectors declined in vales resulting from lack of big-ticket offers.

10. The highest sectors by deal worth have been Telecom (USD 4 billion), Banking & Monetary Companies (USD3.2 billion), and Pharma (USD 2.2 billion).

11. The highest sectors by deal quantity have been Retail (112 offers), IT & ITes (79 offers), and Banking & Monetary Companies (64 offers).

First Revealed: Oct 08 2024 | 3:44 PM ist

Thanks for taking the time to learn this text! I hope you discovered the data insightful and useful. For those who loved one of these content material, please think about subscribing to our publication or becoming a member of our neighborhood. We’d like to have you ever! Be happy to share this text along with your family and friends, who may additionally discover it fascinating.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.