By Malavika Kaur Makol and Ronojoy Mazumdar

India’s $1.3 trillion bond market is dealing with a peculiar concern: buyers cannot get sufficient of sovereign bonds as the federal government buys again debt and cuts borrowings, leading to a provide scarcity.

Click on right here to attach with us on WhatsApp

The administration repurchased almost 245 billion rupees ($2.9 billion) of notes on Thursday. That follows final month’s discount in its Treasury invoice issuance by 400 billion rupees. The Reserve Financial institution of India additionally halted secondary market gross sales of bonds final week for the primary time since July.

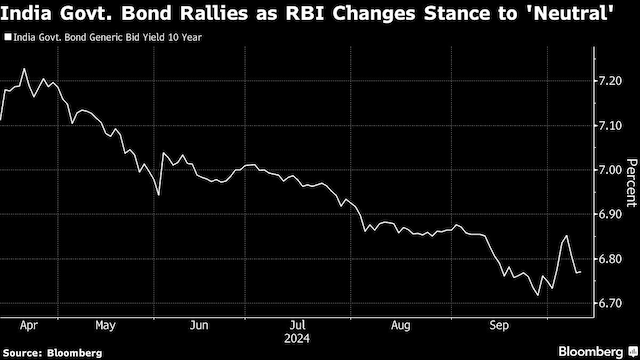

The provision crunch comes simply as Indian bonds have emerged as prime performers amongst main Asian nations, pushed by their current inclusion in international debt indexes. With the RBI’s pivot to a impartial financial coverage stance setting the stage for potential fee cuts, demand is anticipated to rise additional.

The “RBI stance change will add gasoline to fireside as bond markets will begin pricing in 50-75 foundation factors of cuts beginning December,” stated Sagar Shah, head of home markets at RBL Financial institution. “That is the primary time in 2024 that demand for presidency bonds has outstripped provide.”

Barclays Plc estimates the FTSE Russell inclusion this week to lure as much as $9 billion. That is along with the greater than $18 billion that is are available in since JPMorgan Chase & Co.’s September 2023 announcement so as to add India to their most important emerging-market index. A bond public sale final week confirmed buyers bidding almost 3 times the quantity the federal government supplied to boost.

)

India slashed its borrowings for the fiscal 12 months ending in March 2025 this 12 months, in a bid to slim its fiscal deficit. Quick-term borrowing charges for India have been trending decrease, as the federal government slows borrowing by Treasury payments.

“For years we spent hours considering who will purchase Indian bonds, the place demand was going to return from,” stated Nathan Sribalasundaram, charges strategist at Nomura Holdings Inc. “Now we’re fearful there’s not sufficient provide.”

India authorities bonds have been “our highest conviction commerce even earlier than the change within the RBI stance and the FTSE announcement,” stated Eric Lo, Asia mounted revenue portfolio supervisor at Manulife Funding Administration in Hong Kong. “This elevated demand ought to theoretically reprice the federal government bond yield curve decrease,” he stated.

(Updates with bond buyback end in 2nd paragraph)

© 2024 Bloomberg LP

First Printed: Oct 10 2024 | 7:42 PM ist

Thanks for taking the time to learn this text! I hope you discovered the data insightful and useful. In case you loved one of these content material, please take into account subscribing to our e-newsletter or becoming a member of our neighborhood. We’d like to have you ever! Be happy to share this text along with your family and friends, who may also discover it fascinating.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.