)

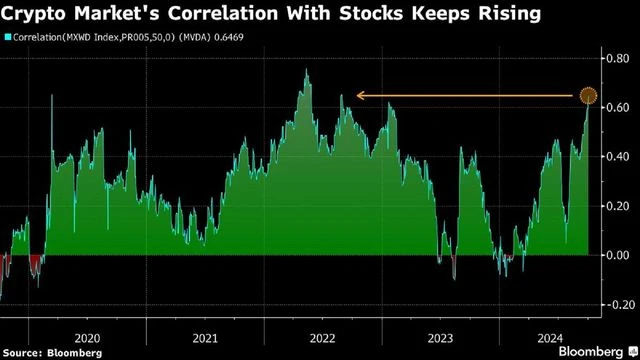

A 50-day correlation coefficient for a gauge of the highest 100 digital tokens and MSCI Inc.’s international fairness index is at 0.65. , Photograph: Shutterstock

Bitcoin speculators banking on a seasonal October melt-up confronted an early actuality examine as deepening rigidity within the Center East spurred a bout of warning throughout international markets.

The digital asset fell 4.7 per cent on Tuesday, probably the most in almost a month, after Iran fired about 200 ballistic missiles at Israel in a pointy however temporary escalation of hostilities between the 2 adversaries. The token pared a few of the drop on Wednesday, altering arms at round $61,260 as of seven:43 am in New York.

Click on right here to attach with us on WhatsApp

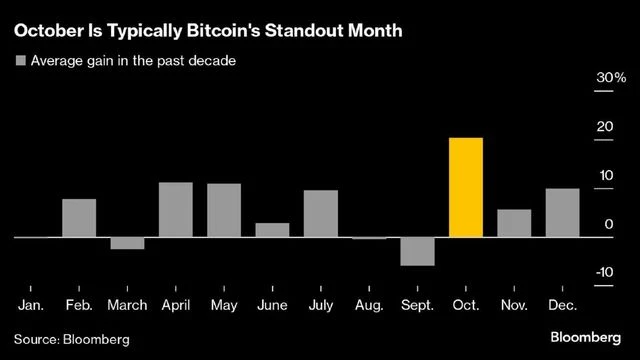

Bitcoin has shed about 4 per cent within the first two days of October, a distinction with its common 20 per cent climb over the month as a complete previously decade, in line with information compiled by Bloomberg. That historic sample sparked hopes of a carry previous March’s document excessive of $73,798, till arguably the largest geopolitical fault-line in international markets poured some chilly water over the optimists.

)

Sean McNulty, director of buying and selling at liquidity supplier Arbelos Markets, argued that the selloff is a “momentary setback” provided that the Federal Reserve has begun reducing rates of interest. The federal government that emerges after November’s US presidential election can be prone to be friendlier towards crypto, he mentioned.

“The seasonal development of October being one of the best month for Bitcoin is alive and properly,” McNulty added.

For now, markets are on alert for intensifying battle as they parse Israeli Prime Minister Benjamin Netanyahu’s vow to retaliate in opposition to Iran’s strikes. US fairness futures dipped Wednesday, whereas oil costs rose on provide fears.

)

Digital property have moved extra in tandem with shares lately, indicating macroeconomic drivers like financial coverage are key for Bitcoin in the mean time.

A 50-day correlation coefficient for a gauge of the highest 100 digital tokens and MSCI Inc.’s international fairness index is at 0.65, the best since 2022, in line with information compiled by Bloomberg. A studying of 1 signifies property are transferring in lockstep, whereas minus 1 alerts an inverse tie.

“The geopolitical atmosphere does not look conducive to threat property,” mentioned Caroline Mauron, co-founder of Orbit Markets, a supplier of liquidity for buying and selling in digital-asset derivatives.

First Revealed: Oct 02 2024 | 11:43 PM ist

Thanks for taking the time to learn this text! I hope you discovered the knowledge insightful and useful. Should you loved this sort of content material, please think about subscribing to our e-newsletter or becoming a member of our group. We’d like to have you ever! Be happy to share this text along with your family and friends, who may additionally discover it attention-grabbing.

Rishabh Singh is the Editor-in-Chief and CEO of Latestnews24.com. He has also completed his graduation in BSC Aviation and has 2+ years of experience in blogging and digital marketing. Have worked with many businesses and blogs, He is also interested in Entertainments/movies/web stories and new foods recipes news, Actually this is his favorite subject. So he is always ready for discussion and written about this topic.