Financial institution of Baroda (BoB) has launched a particular 400-day time period deposit scheme that gives an rate of interest of seven.9 per cent to tremendous senior residents for the pageant season.

Key options of ‘bob Utsav Deposit Scheme’

Click on right here to attach with us on WhatsApp

– 7.30 per cent every year (pa) rate of interest for normal residents.

– 7.80 per cent pa for senior residents.

– 7.90 per cent pa for tremendous senior residents (aged 80 years & above).

– As much as 7.95 per cent pa on non-callable deposits.

The scheme is relevant to mounted deposits beneath Rs 3 crore and is obtainable for a restricted interval.

Further pageant choices

Financial institution of Baroda has additionally launched a number of different enhancements to its deposit merchandise:

Elevated rates of interest: The state-owned financial institution has raised rates of interest by 30 foundation factors (bps) within the three- to five-year buckets, from 6.50 per cent pa to six.80 per cent pa.

SDP scheme advantages: Prospects of the bob Systematic Deposit Plan (SDP) can now lock in increased rates of interest for every month-to-month contribution made for a 3 to five 12 months interval.

Earth Inexperienced Time period Deposits: Rates of interest on these environmentally-focused deposits have been elevated by 30 foundation factors (bps) in choose tenors.

For tremendous senior residents: The financial institution launched a Tremendous Senior Citizen class for patrons aged 80 years and above, providing an extra 10 bps curiosity on prime of the senior citizen fee for time period deposits above 1 12 months to as much as 5 years.

“The bob Utsav Deposit Scheme is a superb alternative for depositors to acquire the next fee of curiosity at this level within the rate of interest cycle. Additional, with a considerable fee enhance within the three- to five-year class, we’re catering to 2 numerous units of shoppers – these searching for aggressive and warranted returns over the medium-term in addition to prospects who wish to construct their financial savings. via common contributions each month via bob SDP and might safe the next fee of curiosity for every month-to-month deposit,” stated Debadatta Chand, managing director and chief govt officer of Financial institution of Baroda.

Prospects can avail of those new deposit schemes via any Financial institution of Baroda department or through the financial institution’s digital channels, together with the bob World app and the financial institution’s web banking platform.

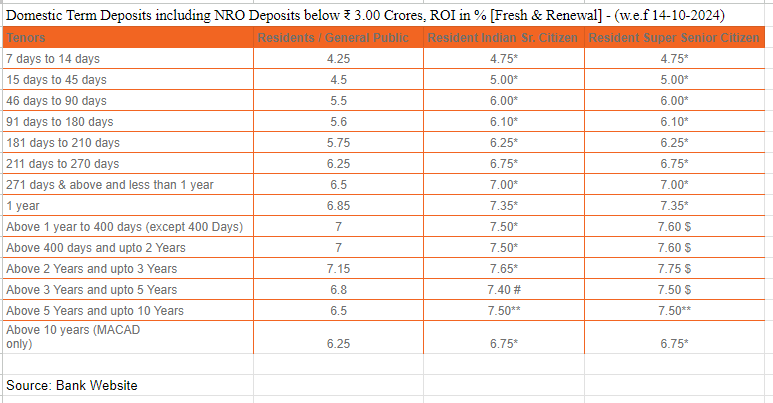

(* incl. further ROI 0.50% for RTD upto 3 Years and extra ROI 0.50% for Above 10 Years, # incl. further ROI of 0.50+0.10 (lowered from 0.15%) for RTD above 3 Years and upto 5 Years wef 14.10. 2024, **incl. further ROI of 0.50%+0.50% for RTD above 5 Years and upto 10 Years to Resident Senior Residents and $ contains 0.10% for Senior Residents for Deposits above 1 12 months and upto 5 years)

(* incl. further ROI 0.50% for RTD upto 3 Years and extra ROI 0.50% for Above 10 Years, # incl. further ROI of 0.50+0.10 (lowered from 0.15%) for RTD above 3 Years and upto 5 Years wef 14.10. 2024, **incl. further ROI of 0.50%+0.50% for RTD above 5 Years and upto 10 Years to Resident Senior Residents and $ contains 0.10% for Senior Residents for Deposits above 1 12 months and upto 5 years)

First Revealed: Oct 15 2024 | 1:12 pm ist

Thanks for taking the time to learn this text! I hope you discovered the knowledge insightful and useful. When you loved one of these content material, please think about subscribing to our e-newsletter or becoming a member of our group. We’d like to have you ever! Be happy to share this text along with your family and friends, who may also discover it attention-grabbing.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.