)

The dockyards at Haifa Port past metropolis buildings in Haifa, northern Israel. Photographer: Kobi Wolf/Bloomberg

Israel was downgraded for the second time this yr by Moody’s Rankings because the financial prices mount from virtually 12 months of combating in Gaza and an worsening battle with Hezbollah.

Moody’s lower Israel by two notches to Baa1 from A2, the rankings firm stated late on Friday, leaving the nation three steps above non-investment grade. The outlook stays adverse.

Click on right here to attach with us on WhatsApp

The “geopolitical threat has intensified considerably additional, to very excessive ranges, with materials adverse penalties for Israel’s creditworthiness in each the close to and long term,” Moody’s stated in its unscheduled announcement. “The depth of the battle between Israel and Hezbollah has elevated considerably in current days.”

)

There’s little signal the struggle in opposition to Hamas is coming to an finish, even when the depth of combating has eased. And up to now two weeks, Israel has ramped up hostilities in opposition to Hezbollah, a Lebanon-based militant group. Fears are rising amongst world powers a couple of potential Israeli floor invasion of southern Lebanon, which may spark a wider regional battle involving Iran, the primary sponsor of Hezbollah, and the US.

The US, France and Arab states are frantically stepping up diplomatic efforts to keep away from that situation.

Moody’s transfer is “extreme and unjustified,” Yali Rothenberg, the Israeli finance ministry’s accountant basic, stated.

“The depth of the ranking motion taken doesn’t match the fiscal and macroeconomic information of the Israeli economic system,” he stated. “It’s clear that the struggle on the varied fronts exacts a value from the Israeli economic system, however there isn’t a justification for the ranking firm’s resolution.”

Moody’s resolution was made even earlier than Israel struck Hezbollah’s headquarters in southern Beirut on Friday within the heaviest assault on the Lebanese capital in virtually 20 years. The event was a serious escalation of hostilities.

The conflicts have proved financially pricey for Israel. Authorities spending and the price range deficit are hovering, whereas sectors similar to tourism, agriculture and building have slumped.

Israeli officers estimated struggle prices by the top of subsequent yr would quantity to roughly $66 billion, or greater than 12 p.c of gross home product. That determine was based mostly on the combating with Hezbollah not escalating into an full-blown confrontation.

Moody’s stated it doubts Israel’s monetary rebound might be fast as soon as hostilities finish.

“Long run, we take into account that Israel’s economic system might be extra durably weakened by the navy battle than anticipated earlier,” it stated. “With heightened safety dangers — a social consideration — we now not count on a swift and robust financial restoration as in earlier conflicts.”

Israel’s 12-month trailing price range deficit stood at 8.3 p.c of GDP in August. The nation’s full-year fiscal hole is ready to be the widest this century, excluding the Covid-19 pandemic.

This month, the finance ministry lower its 2024 financial progress projection to 1.1 per cent from 1.9 per cent. The estimate for subsequent yr was lowered to 4.4 per cent from 4.6 per cent.

Rothenberg, the accountant basic, known as for “decisive and fast steps” to approve a state price range for 2025. The finance ministry and central financial institution have been saying for months that the method to approve one on time is not on time and that politically-sensitive spending. cuts might be wanted in some areas to counter elevated protection spending.

“The state price range should encourage progress engines, funding in infrastructure, consideration of social wants and reply to Israel’s safety necessities,” Rothenberg stated.

)

The federal government’s borrowing — most of it within the home market — has soared to fund the struggle effort. The shekel has been resilient, thanks largely to the central financial institution saying a $30 billion bundle to help the foreign money quickly after the struggle in opposition to Hamas erupted in October.

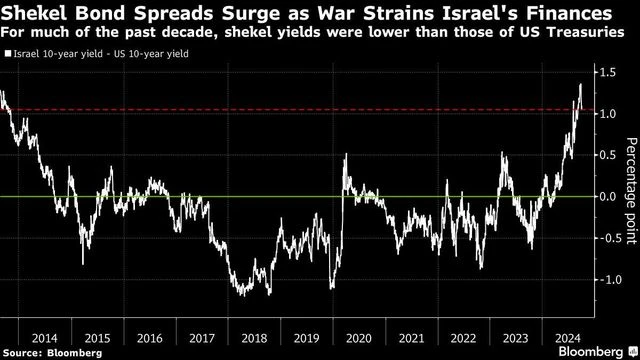

Nonetheless, Israeli bonds have taken successful. Yields on 10-year shekel notes are up virtually 100 foundation factors this yr and their spreads over US Treasuries are at an 11-year excessive. Israel’s greenback bonds are among the many worst-performing globally when in comparison with different sovereign issuers, in line with Bloomberg indexes.

Moody’s lowered Israel’s ranking to A2 from A1 in February, in what was the nation’s first-ever downgrade. The battle will “materially elevate political threat for Israel in addition to weaken its govt and legislative establishments and its fiscal energy,” Moody’s stated on the time.

Again then, Prime Minister Benjamin Netanyahu downplayed the affect of the transfer, which was adopted by S&P World Rankings downgrading Israel to A+ and Fitch Rankings decreasing it to A.

Hezbollah and Hamas are each designated as terrorist teams by the US. Netanyahu says the navy’s bombardment of Hezbollah targets will proceed till Israelis displaced from northern communities are capable of return residence.

Hezbollah says its assaults on Israel will not cease till there is a stop hearth in Gaza.

(Solely the headline and film of this report could have been reworked by the Enterprise Normal employees; the remainder of the content material is auto-generated from a syndicated feed.)

First Printed: Sep 28 2024 | 6:33 PM ist

Thanks for taking the time to learn this text! I hope you discovered the data insightful and useful. If you happen to loved this kind of content material, please take into account subscribing to our publication or becoming a member of our group. We’d like to have you ever! Be happy to share this text along with your family and friends, who may additionally discover it attention-grabbing.

Rishabh Singh is the Editor-in-Chief and CEO of Latestnews24.com. He has also completed his graduation in BSC Aviation and has 2+ years of experience in blogging and digital marketing. Have worked with many businesses and blogs, He is also interested in Entertainments/movies/web stories and new foods recipes news, Actually this is his favorite subject. So he is always ready for discussion and written about this topic.