The government recently launched National Pension System Vatsalya (NPS Vatsalya), a retirement saving scheme for children that was introduced in the Union Budget for 2024-25 on July 23.

What is the NPS Vatsalya scheme?

Vatsalya, an extension of the NPS, allows parents to set up pension accounts for their minor children. The scheme will be managed by the Pension Fund Regulatory and Development Authority (PFRDA). Minor subscribers will receive Permanent Retirement Account Number (PRAN) cards upon registration.

Eligibility for NPS Vatsalya:

Age requirement: Open to all minor citizens (below 18 years).

Accounting operations: Can be opened in the name of a minor, operated by a parent or guardian. The minor is the beneficiary.

Opening channels: Accounts can be opened through various Points of Presence regulated by PFRDA, including major banks, India Post, Pension Funds, and online platforms (e-NPS).

Minimum contribution: A minimum contribution of Rs 1,000 per annum is required, with no maximum limit on contributions.

Investment choices: PFRDA lets subscribers invest in government securities, corporate debt and equity in different properties, depending on their risk appetite and return expectations.

How can you create a big corpus for your child with the help of NPS Vatsalya?

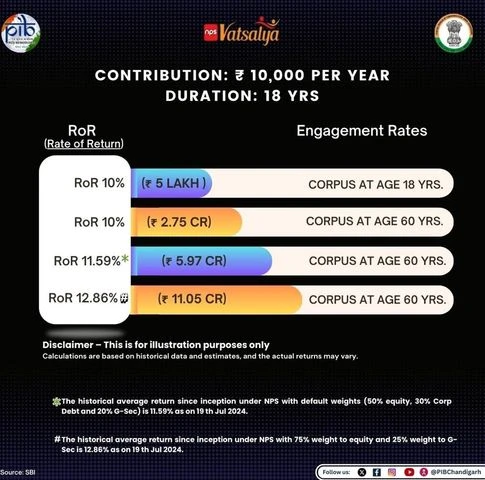

According to a post on

– Annual contribution: Rs 10,000

– Investment duration: 18 years

– Estimated corpus at age 18: Rs 5 lakh (assuming a 10 percent rate of return)

-Estimated corpus at age 60:

– At a 10 percent rate of return: Rs 2.75 crore

– At an 11.59 per cent* rate of return: Rs 5.97 crore

– At a 12.86 per cent# rate of return: Rs 11.05 crore

)

“NPS Vatsalya is an excellent tool to help you build a substantial corpus for your child’s future. Start early and contribute regularly, even small amounts can make a big difference over time. Choose a suitable investment option based on your child’s future needs and maximize your contributions,” said Ritika Nayyar, partner, Singhania & Co.

“Monitor and adjust your investments regularly to ensure they align with your child’s risk tolerance and financial goals. NPS Vatsalya is a long-term investment. It’s important to maintain a disciplined approach and stay focused on your child’s future financial security,” she said.

How to open an NPS Vatsalya account

You may open an NPS Vatsalya account offline and online through the eNPS platform.

This online system simplifies the registration process and allows users to easily make additional contributions, making it more efficient and user-friendly.

You can register with any of the Central Recordkeeping Agencies (CRAs) such as Protean, KFintech, or Cams NPS.

You can also open an NPS account in banks. Here are a few banks that have launched the NPS Vatsalya scheme.

Axis Bank: Visit their closest Axis Bank branch with necessary documents such as the child’s birth certificate, PAN card, and card.

ICICI Bank: To register for NPS Vatsalya, customers can visit their nearest ICICI Bank business centre.

Canara Bank: Visit your nearest bank branch or visit http://pfrda.org.in

Punjab National Bank: To apply online and for more info, visit: https://pnbindia.in/NPS.html

Central Bank of India: You can open an account through all branches; or use the link: https://www.centralbank.net.in/jsp/NPS.html.

Bank of Maharashtra: You can open account using the link to invest in NPS Vatsalya: https://bankofmaharashtra.in/nps-vatsalya#:~:

Documents needed to open NPS account

Date of birth proof (for the minor):

certificate of birth

School leaving certificate

PAN Card

Passport

KYC documents for the guardian:

Aadhaar Card

Driving Permit

Passport

Voter ID Card

National Rural Employment Guarantee Act (NREGA) Job Card

Documents from the National Population Register (NPR)

Bank account:

If the guardian is an NRI:

A Non-Resident External (NRE) or Non-Resident Ordinary (NRO) bank account (either solo or joint) must be opened specifically for the minor.

First Published: Sep 20 2024 | 5:31 PM IST

Thank you for taking the time to read this article! I hope you found the information insightful and helpful. If you enjoyed this type of content, please consider subscribing to our newsletter or joining our community. We’d love to have you! Feel free to share this article with your friends and family, who might also find it interesting.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.