New Delhi:

The country’s central bank, the Reserve Bank of India (RBI), is going to expand further in the nexus of cross-border retail payments. In the coming time, RBI will make domestic fast payment systems (FPS) like Unified Payment Interface (UPI) an easy medium for transactions between people sitting across the border. RBI Governor Shaktikanta Das said that RBI is among the founding members of Project Nexus along with 6 countries. From next year, the fast payment systems of Philippines, Malaysia, and Thailand will be linked to UPI, which will enable the citizens of these countries to do digital transactions of money through UPI.

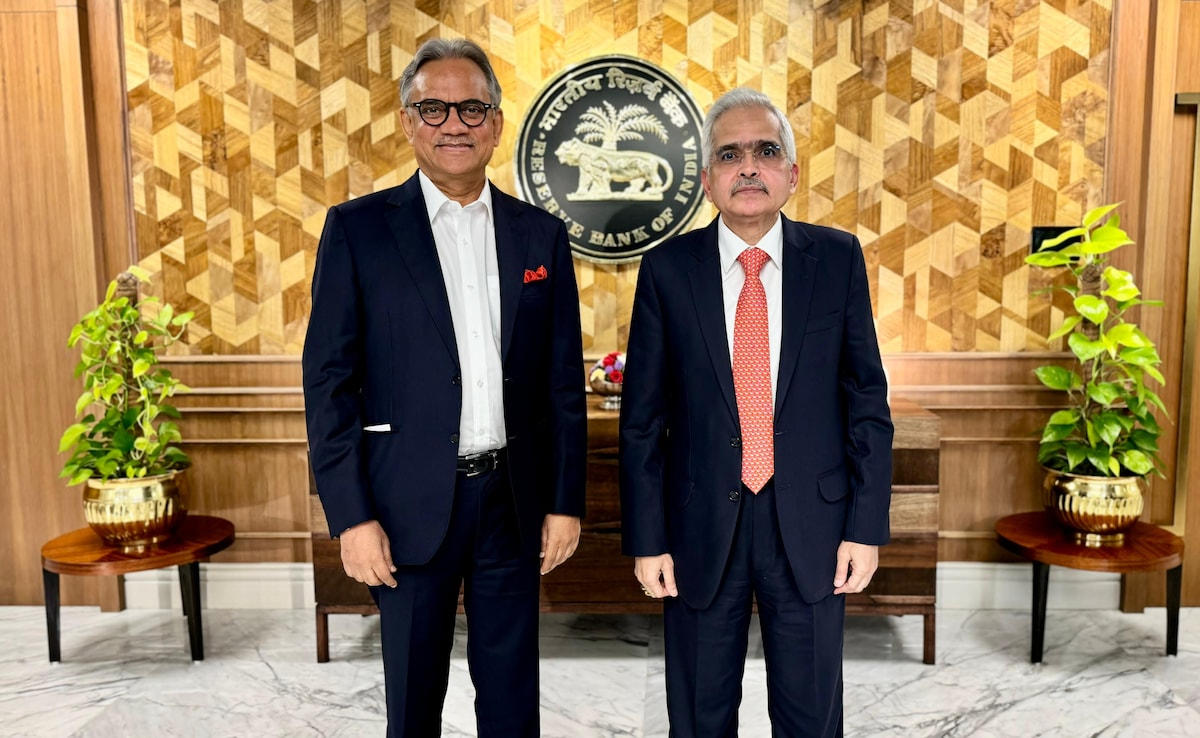

In an exclusive interview with NDTV Editor-in-Chief Sanjay Pugalia, RBI Governor Shaktikanta Das said that RBI has started QR code based payment system with many countries. Fast payment system has also been started with Singapore. Fast payment system is also going to be started with UAE. Indonesia can also join the UPI payment system in future. Our aim behind this is to expand UPI globally and make it a model.

When was UPI launched?

The Modi government launched UPI on 11 April 2016. UPI has been created by the National Payment Corporation of India (NPCI). In India, the operation of RTGS and NEFT payment systems is with the RBI. While IMPS, RuPay and UPI are operated by NPCI. Let us tell you that the government had made a zero-charge framework mandatory for UPI transactions from January 1, 2020.

How did India’s UPI become global?

India has so far launched UPI in France, Sri Lanka and Mauritius. Agreements have been signed with Russia. Deal has been done with Singapore. MOU has been signed with UAE. Talks are going on with Indonesia. Discussions are also going on with Latin America. Things are yet to be finalized with Africa.

RBI also emphasizes on AI

RBI Governor Shaktikanta Das has stressed on the increased use of Artificial Intelligence (AI) in the banking system in the coming days. In an exclusive interview with NDTV Editor-in-Chief Sanjay Pugalia, Shaktikanta Das said, “AI and such modern methods are being used to further strengthen supervision. Problems in the banking sector are also being analyzed through many analytical tools. This is a continuous process. We need to re-evaluate it.”

EXCLUSIVE: “The aim is to explain RBI in the language of common man…”, RBI chief Shaktikanta Das told NDTV

Shaktikanta Das says, “RBI’s focus is mainly to ensure the financial and monetary stability of the country. We are a non-profit organization. Therefore, we do not give any profit or loss to the government every year, but transfer the surplus.”

Repository for digital loan offering apps

RBI Governor said, “Cyber attack is a big threat, which is increasing with the development of technology. In the banking system, we have worked on spreading awareness about cyber attack among customers. We are also creating a public repository for digital loan providing apps.” Shaktikanta Das says, “We are regularly in touch with banks and NBFCs regarding cyber security. We are constantly working with them to improve the quality of cyber security.”

EXCLUSIVE: “Deal well with the challenges after COVID…”, RBI chief Shaktikanta Das told NDTV

The governance standard of the banking system has improved than before

Shaktikanta Das said, “In the banking sector, RBI has tried to improve governance related aspects like risk management, compliance culture in the last 5-6 years. The overall governance standard in the country’s banking system has improved a lot in the last few years.”

EXCLUSIVE: “Economic growth was not sacrificed, India is still the fastest growing economy…”, RBI chief Shaktikanta Das told NDTV

Thank you for taking the time to read this article! I hope you found the information insightful and helpful. If you enjoyed this type of content, please consider subscribing to our newsletter or joining our community. We’d love to have you! Feel free to share this article with your friends and family, who might also find it interesting.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.