Prior to now 4.5 years, Indian buyers have developed a powerful behavior of “shopping for the dip,” particularly within the post-COVID period. With greater than two-thirds of market contributors beginning their investing journeys throughout this time, many have skilled a booming market that has usually favored those that soar in when costs fall.Nevertheless, consultants warning that whereas this strategy has labored nicely in a thriving market , it could not assure success sooner or later.

As market circumstances evolve, buyers needs to be cautious of merely counting on previous developments.

Click on right here to attach with us on WhatsApp

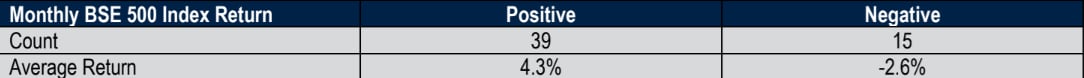

Since April 1, 2020, the BSE 500 Index has delivered spectacular returns, boasting a compound annual progress fee (CAGR) of 32%. Information reveals that out of 54 months throughout this timeframe, there have been 39 months with optimistic returns, averaging 4.3% every month. In distinction, solely 15 months noticed adverse returns, with a mean decline of two.6%. This surroundings has conditioned buyers to view market dips as alternatives relatively than setbacks. For example, on days when the BSE 500 Index declined, home buyers poured a mean of Rs 914 crore into the market. In stark distinction, when the index elevated, they invested solely Rs 443 crore. This illustrates a transparent development: buyers are extra inclined to purchase when costs are down.

“Since April 1, 2020, now we have seen BSE 500 Index ship 2.5x returns or 32% CAGR. These sturdy returns had been delivered with very restricted drawdowns. Thus, now we have seen 39 months of optimistic returns of common 4.3% month-to-month return. Quantity Variety of months witnessing a drawdown had been restricted to simply 15 months, with a mean decline of two.6%. On this surroundings, buyers have constantly been conditioned to speculate increasingly capital as quickly as they see a market decline. strengthened with every market rally submit a dip. Thus, over the past 4.5 years, now we have seen Indian home buyers pour in 2x extra money on a down day versus when markets (BSE 500 Index used as proxy for markets) are up,” stated Vinay Paharia CIO at PGIM Mutual Fund.

Supply: BSE, Information from 1st April 2020 to 4th Oct 2024

Be aware definition of Home Buyers is Indian People + NRI + Proprietary + Home Institutional Buyers.

A Pavlovian Response

This conduct resembles a Pavlovian response, the place buyers have been educated to react to market declines by investing extra. Every market rally following a dip has bolstered this mindset. Over the previous 4 and a half years, the tendency to “purchase the dip” has change into nearly instinctual for a lot of.

“Buyers needs to be very cautious to not extrapolate previous developments whereas partaking in investing, particularly in present market surroundings. Pavlovian conditioning of buyers ensures that each dip will get purchased into. Nevertheless, the outcomes of such investing exercise might not produce the specified outcomes, particularly If held for brief to medium time period, therefore Caveat Emptor (Purchaser Beware).

Buyers ought to rigorously think about their methods and be aware that not each dip will result in a restoration.

First Printed: Oct 16 2024 | 3:34 PM ist

Thanks for taking the time to learn this text! I hope you discovered the knowledge insightful and useful. When you loved one of these content material, please think about subscribing to our e-newsletter or becoming a member of our group. We’d like to have you ever! Be at liberty to share this text along with your family and friends, who may additionally discover it fascinating.

Kanishk Singh has always had a keen interest in fast-paced cars. For the past three years, he has been writing about automobiles, but his fascination with cars dates back even further. He thoroughly enjoys learning about their features and expressing his thoughts through his writing. Kanishk also has a profound interest in the stock market, shares, and business strategies. He possesses a wealth of knowledge on these subjects and consistently writes articles on them. Currently, he is working as a writer for Lattestnews24, specifically focusing on the Automobile, Finance, and Business categories. His well-crafted words are highly appreciated by the readers, as they find them both informative and creative.